All this is included

ABAX's digital mileage log is a fleet mileage tracker which automatically documents trips, mileage reimbursement, and congestion charges according to the requirements of HMRC, providing you with the necessary information to manage your company's service and company cars. All our reports can be automated and are structured in the same simple manner - if you can handle one, you can handle them all.

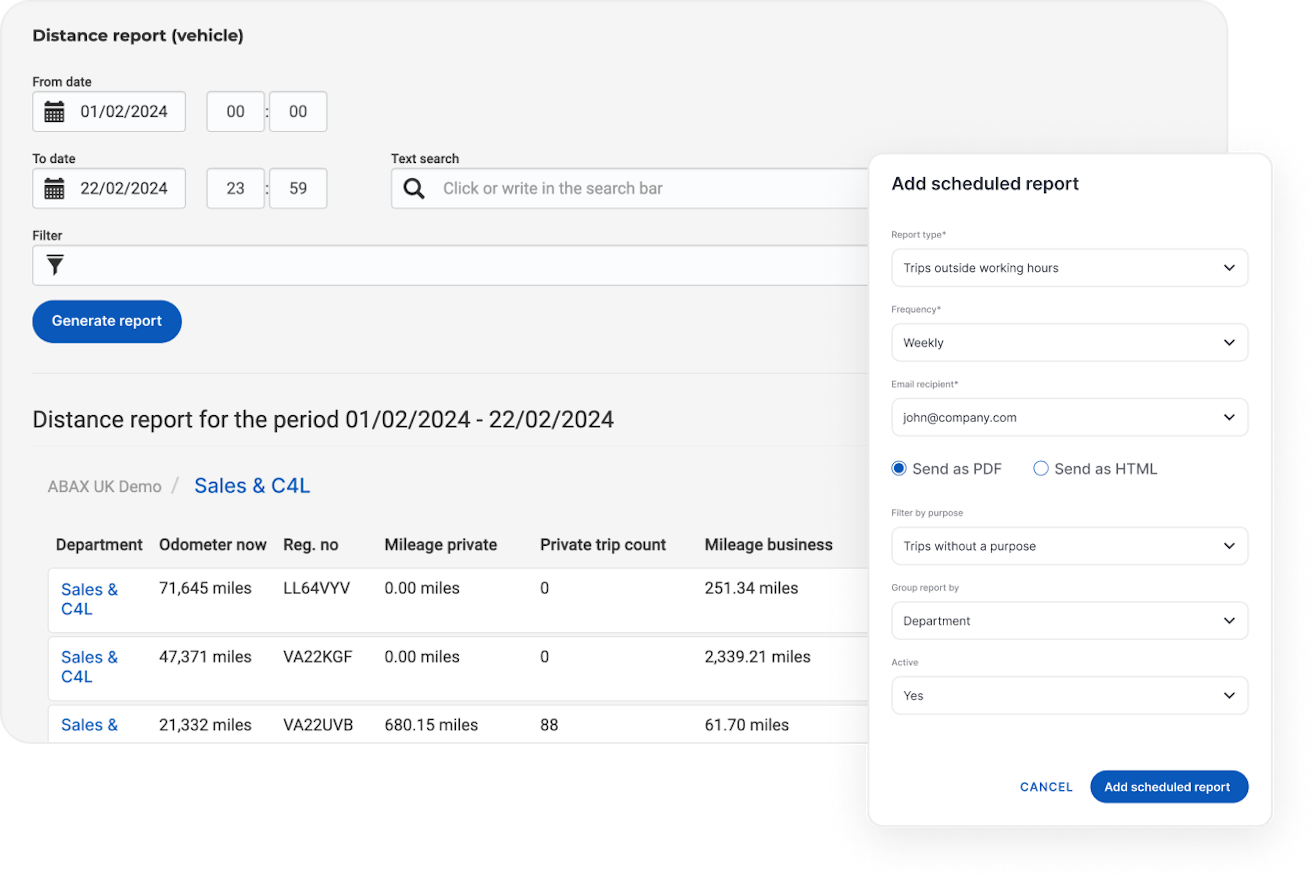

A selection of ABAX Triplog reports:

Status report: Key data for each vehicle

Trip report: Per vehicle, department, and employee

Trip overview: During or outside working hours

Distance report (vehicle): Mileage, distance, number of trips, and time spent

Private use: Distance and time spent on employees' private trips

Company car report: Simplify reporting to payroll/finance by receiving a straightforward summary of your travel data, including tolls and travel reimbursements.

Submitted mileage logs: Overview of submitted reports per driver

Getting started

STEP 1

Easy installation

Create an account and connect your vehicles - no professional installation is required, you can easily do it yourself. If you need help, our customer support is available 24/7.

STEP 2

Document all trips

The system automatically logs travel details such as time, mileage, and addresses. Trips can be categorised as either private or business-related, with the option to specify the purpose of the journey.

STEP 3

Automated reports

Avoid all the hassle of manual administration and receive reports directly to your inbox. Mileage logs are automatically recorded according to the requirements of the HMRC.

Why ABAX Triplog?

Benefits of ABAX Triplog

Better control

Analyse driving data and gain insights through automated reports. Save time, get a better overview, and run a more efficient operation.

Fewer errors, more safety

Ensure compliance with laws and regulations. Our system handles all logging of driving data and ensures accurate documentation in accordance with the HMRC.

Less administration

Save time, increase productivity, and lower your costs by automating time-consuming, manual processes such as mileage logging, invoicing, and reporting.